Heritage

We understand by inheritance “the set of goods, rights and obligations that are not extinguished after the death of a person”. But it is also important that solidarity not be extinguished and continue to be tangible in the projects of the non-profit entities that you include in your will and that you have supported throughout your life.

The distribution of the inheritance is free on your part as a testator. However, in any distribution, the Civil Code obliges to leave a certain proportion of the assets to certain relatives – the heirs who are forced or legitimized – and who responds to what is known as a legitimate obligation. The inheritance includes not only the inheritance in the strict sense, but also all the donations made in life.

In the case of leaving descendants at the time of death, this set of assets formed by inheritance plus donations is divided into three equal parts:

In the case of leaving descendants at the time of death, this set of assets formed by inheritance plus donations is divided into three equal parts:

The strict legitimate is the third of assets that cannot be freely disposed of and that will be destined to the legitimized ones, also called forced heirs. It is distributed among the children in equal parts and if any of them has died, their subsequent descendants inherit by right of representation, that is, by strains.

The third improvement, part that is not freely available, but on which there is some availability. The law establishes that the third improvement must be distributed among children and descendants but not necessarily in equal parts. It can benefit some children against others.

The third of free disposal is the part that as a testator you can leave to whom you choose, be it family or not, and may be a natural or legal person, including any non-profit organization. If there are one or several non-profit causes / entities in the world with which you have always felt identified, you can choose to include them in a will once you have been informed of their work. This part of the inheritance would not be reduced by taxes since the non-profit entity is a legal person is not subject to inheritance tax and, similarly, income derived from inheritances are exempt from corporation tax because it is non-profit entities declared of public utility.

In the event that there is marriage, your wife or husband has the right to be recognized, at least, the usufruct of the third improvement.

However, in the case of dying without descendants but with ascendants (parents or grandparents), they will be entitled to half of the inheritance, as legitimate. In this case, if at the time of death your husband or wife is still alive, he or she will be entitled to the usufruct of half of the inheritance.

Persons who die without ancestors or descendants, but with a husband or wife, must recognize this or this one the usufruct of two thirds of the inheritance.

This regulation contains exceptions in some Autonomous Communities, so in Navarre there is only one legitimate formal (it is enough to mention the legitimaries, without the need to leave them property), or in Catalonia there is only a quarter and only in favor of the descendants. There are also special rules in the Balearic Islands, the Basque Country and Aragon.

What Happens If I Do Not Make A Will?

Remember that the will is just an act that gives you freedom to choose how you want to distribute your assets. In case there is no will, or if it is considered null or in some other case (for example, if the heirs die before you as a testator or all the forced heirs have not been included), the law establishes who are the heirs of the deceased.

– In the first place, children and descendants (grandchildren only if they have died or can not or do not want to inherit their parents) with respect to their parents and ascendants and without any discrimination by sex, age or filiation.

– In the first place, children and descendants (grandchildren only if they have died or can not or do not want to inherit their parents) with respect to their parents and ascendants and without any discrimination by sex, age or filiation.- – In the second place, and in the absence of the previous ones, the parents and ascendants closest to the degree. In case the parents do not live, the grandparents inherit.

- – Third, the spouse, who inherits in the absence of descendants and ascendants and before brothers.

- – Finally, the so-called collaterals, brothers (who inherit equally), nephews, uncles. The other relatives up to the fourth degree (cousins) will inherit in the absence of the previous ones. If there is no testament, it is not possible to inherit beyond the fourth degree of kinship.

In the absence of all the previous ones, the State inherits, although in some Autonomous Communities it is precisely the respective Autonomous Community. This order is different in some Autonomous Communities such as the Basque Country and Navarre. If you do not have relatives or loved ones with whom to share your inheritance in the future, you can name one or several non-profit entities as universal heirs, and allocate all your assets to continue building a better world.

To prove the status of heir it is necessary to prove the death and carry out a process of declaration of heirsabintestato, which can be judicial or notarial and whose costs are, in any case, higher than a testament.

Legacy

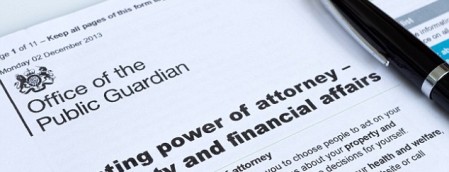

As a testator in your will, in addition to naming an heir, that is, designating the person or persons who receive the generality of the assets and rights, you can also leave specific assets or rights to a person, physical or legal.

These goods can be a property (a property, a car, a work of art, jewelry, etc.) or a right (a benefit, the collection of a debt, a patrimonial percentage, etc.). You can also bequeath assets that are not in your estate as a testator. In this case, the heirs must acquire the property for the legatee (the person who receives the legacy) with the heritage of the inheritance (for example, “that a car be charged to a person” from bank account X).

The specificity of the legacies is that they have a limit: they cannot harm in any case the legitimacy of the forced heirs. In addition, they must be mandatorily granted by will and expressly indicated.

If you decide to include any non-profit entity in your will, it is important that you share your decision with someone on your team, not only to verify your identification data, but to guarantee compliance with your will. In addition, you will be able to know your work more directly.…

The third modality in this category is the holographic testament that would be drawn up by your own handwriting. It is subject to some minimum but essential formalities (date, unequivocal will, signature at the end …) and, in the case of choosing to collaborate with one or several non-profit entities, they must be included as heirs or specify in writing the solidarity legacy that you want to donate It needs, for its effectiveness, special procedures with judicial intervention, the death of the testator. It is a document, sometimes dangerous, because it lacks advice and more cost than any other, by the subsequent judicial procedure.

The third modality in this category is the holographic testament that would be drawn up by your own handwriting. It is subject to some minimum but essential formalities (date, unequivocal will, signature at the end …) and, in the case of choosing to collaborate with one or several non-profit entities, they must be included as heirs or specify in writing the solidarity legacy that you want to donate It needs, for its effectiveness, special procedures with judicial intervention, the death of the testator. It is a document, sometimes dangerous, because it lacks advice and more cost than any other, by the subsequent judicial procedure. In the case of leaving descendants at the time of death, this set of assets formed by inheritance plus donations is divided into three equal parts:

In the case of leaving descendants at the time of death, this set of assets formed by inheritance plus donations is divided into three equal parts:

– In the first place, children and descendants (grandchildren only if they have died or can not or do not want to inherit their parents) with respect to their parents and ascendants and without any discrimination by sex, age or filiation.

– In the first place, children and descendants (grandchildren only if they have died or can not or do not want to inherit their parents) with respect to their parents and ascendants and without any discrimination by sex, age or filiation. Being older than 14 years old.

Being older than 14 years old. …

…